There’s nothing like the freedom of running your own business. But delivering a product or service is only part of the job. Proper financial administration and bookkeeping can make or break your business.

Table of Contents

So how do you keep track of your financial records? Do you know who to bill and can you track your profits?

The right accounting software can do all of this and more. Keep reading to find out the hits and misses with some of the most popular accounting software for freelancers.

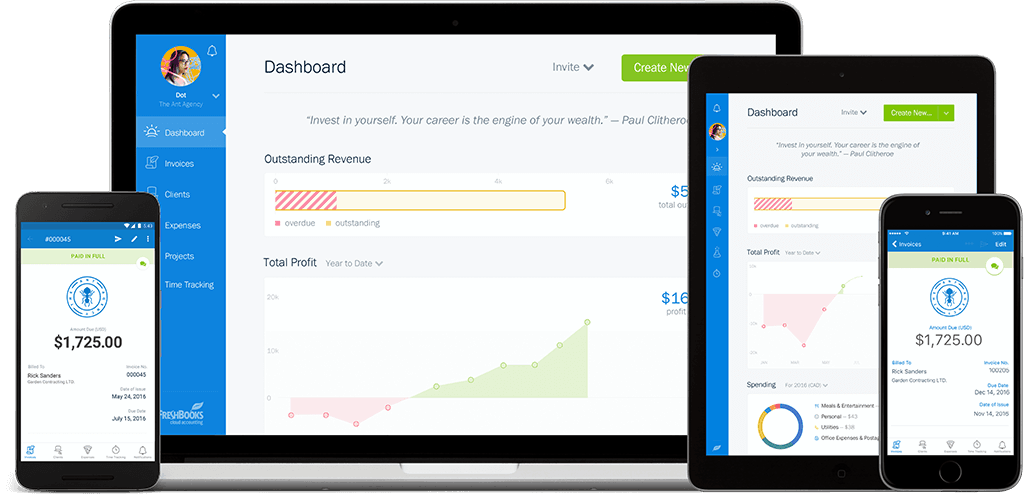

FreshBooks gives you a fresh look at complicated accounting software. Valued for its simplistic interface, FreshBooks has everything a small business needs to organize those pesky financial details.

Why would you choose FreshBooks over any other accounting software? The helpful features can be a life- and time-saver for anyone who doesn’t have an entire department to take care of such things. Check out some of FreshBooks’ convenient features.

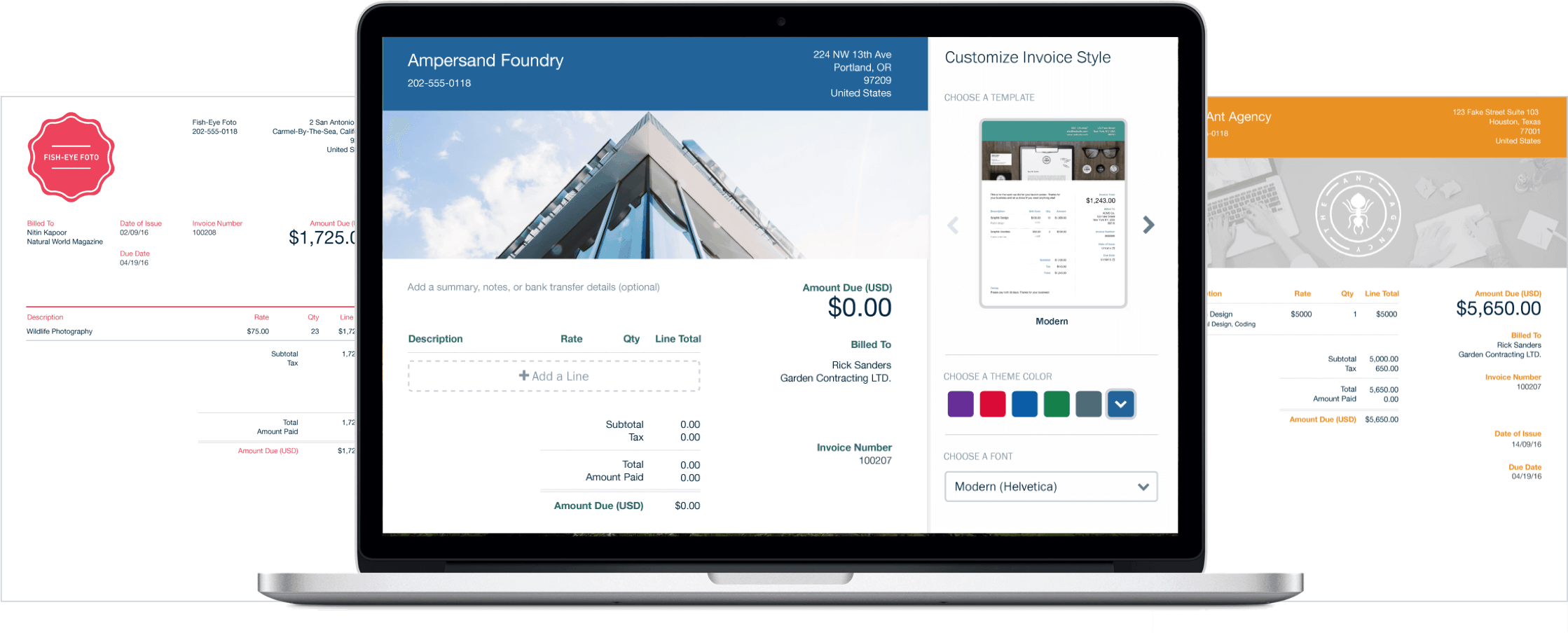

You may not have thought about personalization and customization when it comes to accounting software. But FreshBooks offers a fresh and simple look to financial software. And it’s easy to adjust settings to make it work best for your individual needs.

Billing and invoicing is the mainstay of the self-employed. And this may be why you’re looking at software options. FreshBooks makes it easy to take care of financial details without needing an accountant to see this essential part of the business.

Do you have multiple projects going on at once? FreshBooks makes it simple to track billable time, expenses, and due dates. Keep on top of project details and export billable information directly into a client’s invoice.

Client interaction can make you stand out in the crowd. And as a freelancer, you may work closely with your clients to collaborate on projects.

Why use a separate program to get client input? Instead, try the optional invitation feature on FreshBooks. Inviting clients into your virtual workroom keeps them in the loop, and makes communication more efficient.

FreshBooks Cloud Accounting is free to try for 30 days. And you don’t need to give your credit card info to give it a spin.

If you find this software is perfect for you? Sign up for one of the 3 plans:

The Lite plan is a good option if you only have a handful of clients at a time. It’s only $15 a month and includes the following perks:

If you have a medium-sized client base, then the Plus plan may be the one for you. At only $25 a month it features the same perks as Lite with these extra features:

Are you a freelancing powerhouse? Then you may like the Premium plan from FreshBooks. It offers the same perks as both the Lite and Plus plans, but you also receive support for up to 500 clients. At $50 a month, this FreshBooks plan gives you everything you need to grow your business.

Do you need to give your employees access to FreshBooks? For an extra $10 per person per month, you can do that. Add on more team members as you need them to track projects, time, and expenses.

Do you make more than 150K a year or have more than 500 clients? You may need FreshBooks Select instead. This plan’s features may be perfect for your growing business, including a dedicated account manager, advanced accounting integrations, lower transaction fee rates, and payment fee reports. Though if you have more than 500 clients it might make sense to look at Quickbooks.

If you’re looking into accounting software, it’s hard to get away from Intuit’s QuickBooks. It’s a mainstay on the market and has been for years. But is it the right one for you?

What do you need from your accounting software? QuickBooks has been an industry leader for years. Check out the features that they’re famous for and see if it’s a good fit for your business:

Interested in trying QuickBooks for yourself? They offer a 30-day free trial, but after that, you can choose from one of 3 plans for small businesses. Or one special-priced plan for anyone self-employed.

For $10 a month, freelancers can have access to some of QuickBooks’ signature features like:

However, this plan is exclusively for sole proprietors who file Schedule C. If you have any other type of business, you may need to check out the other plans. Also, you can’t upgrade from a Self-Employed plan to a Small Business plan.

According to QuickBooks, you qualify for one of their small business plan options if you are one of the following:

All small business plans are upgradable. But you can’t go from Self-Employed to a Small Business Plan.

This basic plan gives you all the basic accounting features you may need to organize your financial records. For $20 a month, you receive the following QuickBooks perks:

If you need just a little more from your accounting software, the next level is the Essentials plan. This plan is $35 a month and includes everything from the Simple Start plan. It adds bill management and track time capabilities.

And if you have a business that may require multiple users? You can have up to 3 users per account.

For a small business with a lot of accounting demands, the Plus plan may be the only way to go. At $60 a month, you receive the same basic features as the Simple Start and Essentials plans with a few key differences.

The Plus plan allows you to run advanced reports instead of just basic ones. You can also allow access for up to 5 users. Additional features for this premium plan include inventory and project tracking and 1099 contractor management.

If you only need access to a special feature or two, you can also buy add-ons to your existing plan. Potential add-ons include:

As you research accounting software, you may come across Xero. Their mission is to supply simple software for small business needs. And they supply all the features that your small business may need for day-to-day operations.

Does Xero offer exactly what you need for your business? If you think they do, you can try their free trial. You don’t need a credit card to sign up. And you have unlimited user access for the first 30 days.

If you think that Xero is exactly what you need to manage your financial details, you may want to check out the following available plans. Xero last increased their pricing in November of 2018.

Do you need a simple software to handle a handful of transactions a month? This plan may be a good option. For $9 a month, receive the following Xero features:

If you’re growing your business, however, you may want to invest in the Growing plan instead. This plan features unlimited invoicing and quotes, bill entry, and bank transactions for $30 a month.

For those of you who have advanced financial needs, the Established plan may be the way to go. For $60 a month, you receive pro features like expenses and projects and multi-currency capabilities.

Need an efficient way to process your payroll? Xero offers a full-service payroll upgrade and add-on to take care of it. This service is available across all 50 states in the US. It starts at $39 per month with an added $6 per person per month.

You may be tempted to go with the first financial software you come across. But how does one stack up against the other? Check out these quick comparisons.

Winner FreshBooks. Not all accounting software packages are created equal. And there are some glaring differences between FreshBooks and QuickBooks that may be deal-breakers for either one.

One of the major differences is the price plans. QuickBooks offers its price plans based on the number of users who may need access to the software. On the other hand, FreshBooks uses your client base number to determine the best plan for you.

Another difference is the ease of set-up, or the lack thereof. FreshBooks set-up is simple and the interface is very beginner user-friendly. But QuickBooks requires a lot of calibration to get it to where it needs to be. The learning curve may be a bit steep for some users.

Next, invoicing for FreshBooks is simple and streamlined. It is relatively straightforward, but it doesn’t have as many options as QuickBooks. Quickbooks is built for small businesses.

In addition, FreshBooks makes it very easy to pay expenses. Simply fill in the required fields and you’re done. QuickBooks operates in a similar way when logging expenses. But they also need a linked bank account for paying these expenses. FreshBooks doesn’t require this.

What about tax time? Which is easier? That depends on how you file your taxes. As you may imagine, you can link QuickBooks with Intuit’s tax software Turbo Tax. Or you can give access to your accountant with FreshBooks.

FreshBooks and Xero have a lot of similarities. It may be difficult for a self-employed person to tell which is right for them. They are both strong options for freelancers and small teams. There are a couple of obvious differences, though, that may make this decision easier.

First, it’s the pricing. To receive the bulk of Xero’s signature features you may have to purchase mid-level or premium plans. However, the pricing is based on the number of people under your employ.

So, what happens to the freelancer who simply wants to make professional invoices? Well, you can pay for upgraded plans on Xero to have access to more features even if you don’t have employees. Or you can opt to go with FreshBooks.

FreshBooks bases its plans on the number of clients you intend to invoice, not the number of employees you may or may not have. So, FreshBooks is very price-friendly to freelancers and the self-employed who don’t plan on growing their business to include numerous employees.

Next, setting up Xero is a bit more complicated than setting up FreshBooks. Because of the numerous customizing and importing options, you may not get up and go as quickly. But if you plan on importing a lot of data to the new accounting program, Xero lets you do this with ease.

In addition, invoicing for both FreshBooks and Xero is simple. But you get more customization options for Xero. Maybe too many options. FreshBooks offers two simple and professional templates to choose from. And they are color-coded for easy data input.

Finally, when it comes to tax time, Xero may make it a little easier to file because it already has Avalara integrated. But if you use an outside accountant, this option may be useless.

Xero is a better platform if you do not have clients and run a physical business like a restaurant or farm.

Both QuickBooks and Xero excel at helping small businesses keep track of financial details. And their pricing works similarly, too. But if you are a freelancer, neither plan may make financial sense because they are based on the number of users or people under your employ. If you have neither, you may be paying more for perks you don’t need.

In addition, both the set-ups for QuickBooks and Xero take a bit of time. And there is a little learning curve to either one because they are both very customizable. Though they have set-up wizards to help beginners, it may still be a little too much to get up and running as soon as possible.

Furthermore, as mentioned before, both QuickBooks and Xero offer similar capabilities when logging expenses, filing taxes and invoicing. But both of them are geared towards small businesses with employees. And if you are self-employed, you may find these extra perks unnecessary.

If you are a freelancer or self-employed, the clear winner is FreshBooks. It’s feature-light and user-friendly design make it appealing for those who simply want a basic accounting software. With FreshBooks, you pay for what you actually need based on how many clients you have instead of paying more for employees you don’t actually have.

In addition, the client chatting and sharing capabilities make FreshBooks an appealing and personable software solution for freelancers who depend on relationships with their clients. With a fee, you can also allow your clients to pay with credit cards through FreshBooks’ online payment processing.

Lastly, Xero and QuickBooks also have their own appeal. But unless you are a small business with plans for immediate growth, it may not make fiscal sense to invest in either. FreshBooks, on the other hand, provides just the right combination of simplicity and professionalism that is perfect for maintaining your freelancer freedom.